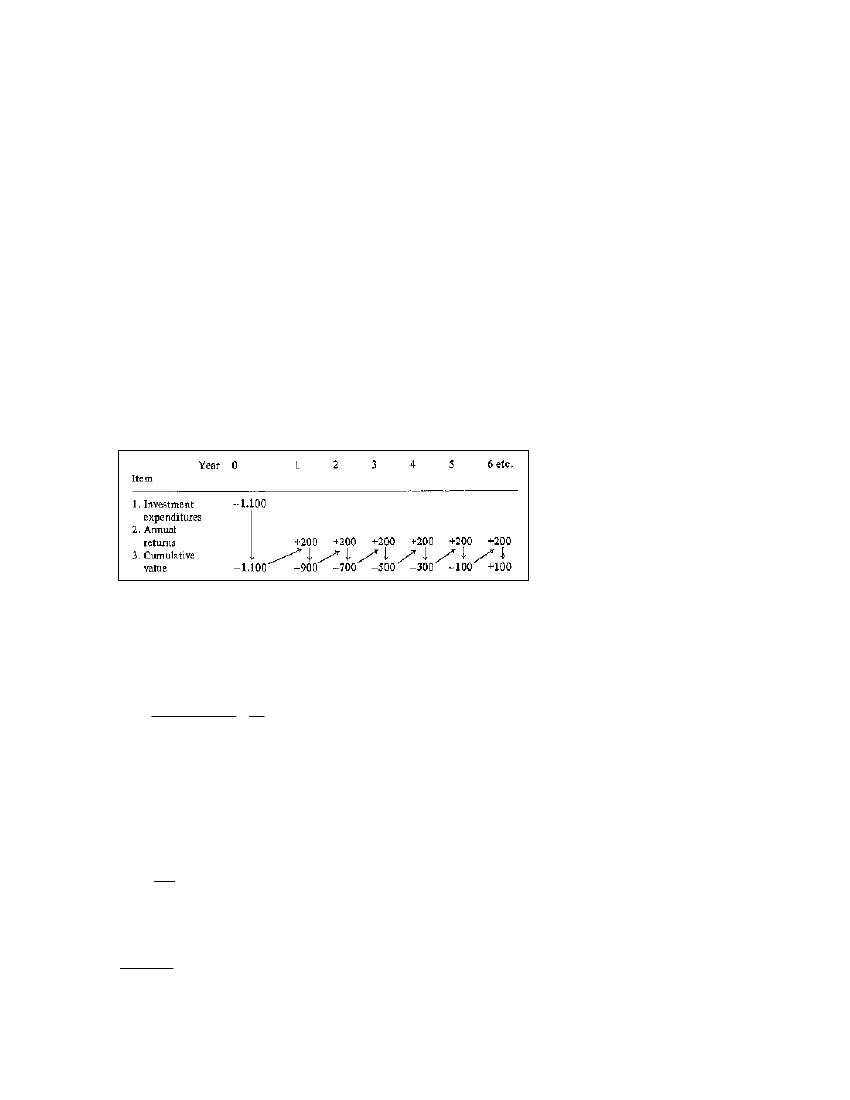

Calculation of the static payback period according to the cumulative method (data taken from the

appendicized formsheet, table 10.10).

Input parameters:

- investment costs

- annual revenues

- less the yearly operating costs

- less the external capital costs

= annual returns

The cumulative method allows consideration of different annual returns.

Calculatory procedure: The investment expenditures and annual returns are added together until

the line-3 total in table 8.3 either reaches zero (end of payback period) or becomes positive.

Evaluation: As far as risk minimization is concerned, a short payback period is very valuable from

the standpoint of the plant's user ("short" meaning significantly less than 10 years, the data listed in

table 8.3 pegs it at 5.5 years). Should the analysis show a payback period of 10 years or more, thus

possibly even exceeding the technical service life of the plant, building the plant could not be

recommended unless other important factors are found to outweigh that disadvantage.

Table 8.3: Schedule of data for

calculating the plant payback

period (with case example;

data taken from the

appendicized formsheet, table

10.l0) (Source: OEKOTOP)

Static calculation of profitability (data taken from table 10.10 in the Appendix)

Input parameters:

- average capital invested per time interval, KA

KA

=

initial

investment

2

=

IO

2

- net profit, NP = annual return

- less the external capital servicing costs

- less the depreciation

Calculatory procedure: The profitability, or return on investment, ROI, is calculated according to the

following formula

ROI

=

NP

KA

⋅100

The linear annual depreciation amounts to:

IO

service life

99