OpenStax College: "How the U.S. and Other Countries Experience Inflation"

Historical Inflation in the U.S. Economy

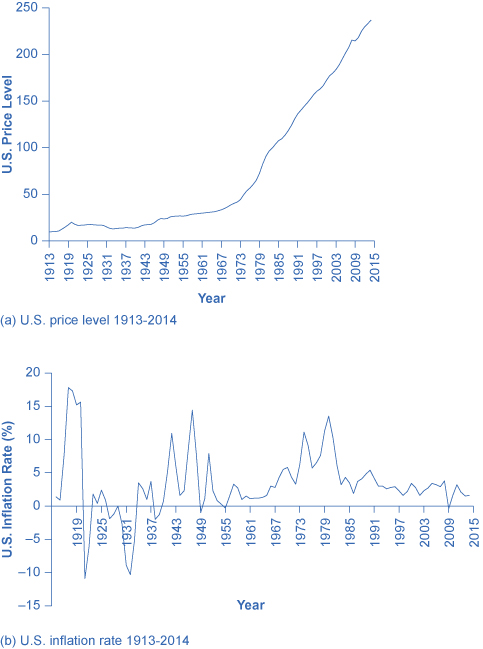

Figure (a) shows the level of prices in the Consumer Price Index stretching back to 1916. In this case, the base years (when the CPI is defined as 100) are set for the average level of prices that existed from 1982 to 1984. Figure (b) shows the annual percentage changes in the CPI over time, which is the inflation rate.

The first two waves of inflation are easy to characterize in historical terms: they are right after World War I and World War II. However, there are also two periods of severe negative inflation—called deflation—in the early decades of the twentieth century: one following the deep recession of 1920–21 and the other during the Great Depression of the 1930s. (Since inflation is a time when the buying power of money in terms of goods and services is reduced, deflation will be a time when the buying power of money in terms of goods and services increases.) For the period from 1900 to about 1960, the major inflations and deflations nearly balanced each other out, so the average annual rate of inflation over these years was only about 1% per year. A third wave of more severe inflation arrived in the 1970s and departed in the early 1980s.

Visit website https://data.bls.gov/cgi-bin/cpicalc.pl to use an inflation calculator and discover how prices have changed in the last 100 years.

Times of recession or depression often seem to be times when the inflation rate is lower, as in the recession of 1920–1921, the Great Depression, the recession of 1980–1982, and the Great Recession in 2008–2009. There were a few months in 2009 that were deflationary, but not at an annual rate. Recessions are typically accompanied by higher levels of unemployment, and the total demand for goods falls, pulling the price level down. Conversely, the rate of inflation often, but not always, seems to start moving up when the economy is growing very strongly, like right after wartime or during the 1960s. The frameworks for macroeconomic analysis, developed in other chapters, will explain why recession often accompanies higher unemployment and lower inflation, while rapid economic growth often brings lower unemployment but higher inflation.

Inflation around the World

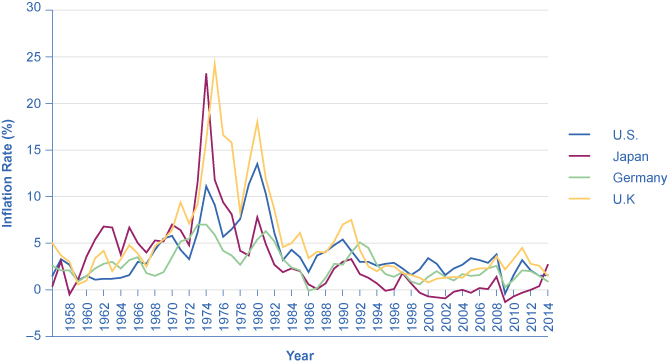

Around the rest of the world, the pattern of inflation has been very mixed, as can be seen in Figure which shows inflation rates over the last several decades. Many industrialized countries, not just the United States, had relatively high inflation rates in the 1970s. For example, in 1975, Japan’s inflation rate was over 8% and the inflation rate for the United Kingdom was almost 25%. In the 1980s, inflation rates came down in the United States and in Europe and have largely stayed down.

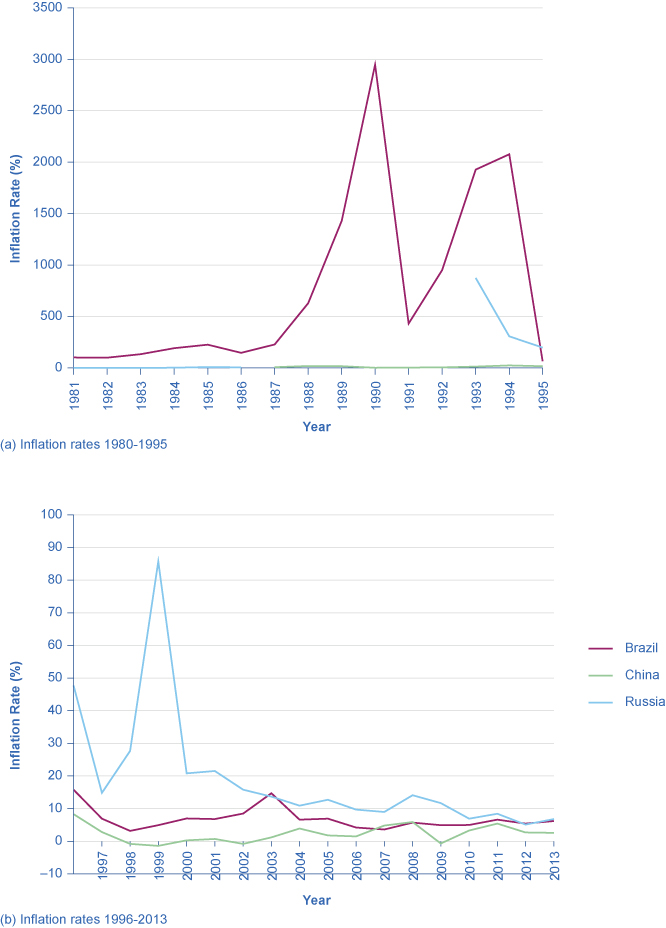

Countries with controlled economies in the 1970s, like the Soviet Union and China, historically had very low rates of measured inflation—because prices were forbidden to rise by law, except for the cases where the government deemed a price increase to be due to quality improvements. However, these countries also had perpetual shortages of goods, since forbidding prices to rise acts like a price ceiling and creates a situation where quantity demanded often exceeds quantity supplied. As Russia and China made a transition toward more market-oriented economies, they also experienced outbursts of inflation, although the statistics for these economies should be regarded as somewhat shakier. Inflation in China averaged about 10% per year for much of the 1980s and early 1990s, although it has dropped off since then. Russia experienced hyperinflation—an outburst of high inflation—of 2,500% per year in the early 1990s, although by 2006 Russia’s consumer price inflation had dipped below 10% per year, as shown in Figure. The closest the United States has ever gotten to hyperinflation was during the Civil War, 1860–1865, in the Confederate states.

Key Concepts and Summary

In the U.S. economy, the annual inflation rate in the last two decades has typically been around 2% to 4%. The periods of highest inflation in the United States in the twentieth century occurred during the years after World Wars I and II, and in the 1970s. The period of lowest inflation—actually, with deflation—was the Great Depression of the 1930s.

Self-Check Question

Go to this website for the Purchasing Power Calculator at MeasuringWorth.com. How much money would it take today to purchase what one dollar would have bought in the year of your birth?

Review Questions

- What has been a typical range of inflation in the U.S. economy in the last decade or so?

- Over the last century, during what periods was the U.S. inflation rate highest and lowest?

- What is deflation?

Critical Thinking Question

Why do you think the U.S. experience with inflation over the last 50 years has been so much milder than in many other countries?

Problems

Within 1 or 2 percentage points, what has the U.S. inflation rate been during the last 20 years? Draw a graph to show the data.

Glossary

- deflation

- negative inflation; most prices in the economy are falling

- hyperinflation

- an outburst of high inflation that is often seen (although not exclusively) when economies shift from a controlled economy to a market-oriented economy