BAE Systems

Did you know...

This Schools selection was originally chosen by SOS Children for schools in the developing world without internet access. It is available as a intranet download. Sponsor a child to make a real difference.

Coordinates: 51°16′25″N 0°46′00″W

| Type | Public limited company |

|---|---|

| Traded as | LSE: BA. |

| Industry | Aerospace, Defence, Information security |

| Predecessor(s) | British Aerospace Marconi Electronic Systems |

| Founded | 30 November 1999 |

| Headquarters | London, United Kingdom |

| Area served | Worldwide |

| Key people | Dick Olver (Chairman) Ian King (CEO) |

| Products | Civil and military aerospace Defence electronics Naval vessels Munitions Land warfare systems |

| Services | Maintenance, consultancy, training etc. |

| Revenue | £17.834 billion (2012) |

| Operating income | £1.640 billion (2012) |

| Profit | £1.079 billion (2012) |

| Employees | 107,000 (2010) |

| Divisions | See below |

| Subsidiaries | BAE Systems Inc. BAE Systems Australia BAE Systems Detica |

| Website | baesystems.com |

BAE Systems plc is a British multinational defence, security and aerospace company headquartered in London, United Kingdom and with operations worldwide. It is among the world's largest defence contractors; it ranked as the third-largest based on applicable 2011 revenues. Its largest operations are in the United Kingdom and United States, where its BAE Systems Inc. subsidiary is one of the six largest suppliers to the US Department of Defense. Other major markets include Australia, India and Saudi Arabia. BAE was formed on 30 November 1999 by the £7.7 billion merger of two British companies; Marconi Electronic Systems (MES) – the defence electronics and naval shipbuilding subsidiary of the General Electric Company plc (GEC) – and British Aerospace (BAe) – an aircraft, munitions and naval systems manufacturer.

BAE Systems is the successor to various aircraft, shipbuilding, armoured vehicle, armaments and defence electronics companies, including The Marconi Company, the first commercial company devoted to the development and use of radio; A.V. Roe and Company, one of the world's first aircraft companies; de Havilland, manufacturer of the world's first commercial jet airliner; British Aircraft Corporation, co-manufacturer of the Concorde supersonic transport; Supermarine, manufacturer of the Spitfire; Yarrow Shipbuilders, builders of the Royal Navy's first destroyers; and Vickers Shipbuilding and Engineering, builders of the Royal Navy's first submarines. Since its formation it has made a number of acquisitions, most notably of United Defense and Armor Holdings of the United States, and sold its shares in Airbus, Astrium, AMS and Atlas Elektronik.

BAE Systems is involved in several major defence projects, including the F-35 Lightning II, the Eurofighter Typhoon, the Astute-class submarine and the Queen Elizabeth-class aircraft carriers. The company has been the subject of criticism, in terms of general opposition to the arms trade and particularly specific allegations of unethical and corrupt practices. BAE Systems is listed on the London Stock Exchange and is a constituent of the FTSE 100 Index.

History

Heritage

BAE Systems was formed on 30 November 1999 by the £7.7 billion merger of British Aerospace (BAe) and Marconi Electronic Systems (MES). As a result, BAE Systems is the successor to many of the most famous British aircraft, defence electronics and warship manufacturers. Predecessor companies built the Comet, the world's first commercial jet airliner; the Harrier "jump jet", the world's first operational Vertical/Short Take-Off and Landing (VTOL) aircraft; the "groundbreaking" Blue Vixen radar carried by Sea Harrier FA2s and which formed the basis of the Eurofighter's CAPTOR radar; and co-produced the iconic Concorde supersonic airliner with Aérospatiale.

British Aerospace was a civil and military aircraft manufacturer, as well as a provider of military land systems. The company had emerged from the massive consolidation of UK aircraft manufacturers since World War II. British Aerospace was formed on 29 April 1977 by the nationalisation and merger of The British Aircraft Corporation (BAC), the Hawker Siddeley Group and Scottish Aviation. Both BAC and Hawker Siddeley were themselves the result of various mergers and acquisitions.

Marconi Electronic Systems was the defence subsidiary of British engineering firm The General Electric Company (GEC), dealing largely in military systems integration, as well as naval and land systems. Marconi's heritage dates back to Guglielmo Marconi's Wireless Telegraph & Signal Company, founded in 1897. GEC purchased English Electric (which included Marconi) in 1968 and thereafter used the Marconi brand for its defence businesses (as GEC-Marconi and later Marconi Electronic Systems). GEC's own defence heritage dates back to World War I, when its contribution to the war effort included radios and bulbs. World War II consolidated this position, as the company was involved in important technological advances, notably the cavity magnetron for radar. Between 1945 and 1999, GEC-Marconi/Marconi Electronic Systems became one of the world's most important defence contractors. GEC's major defence related acquisitions included Associated Electrical Industries in 1967, Yarrow Shipbuilders in 1985, Plessey companies in 1989, parts of Ferranti's defence business in 1990, The rump of Ferranti when it went into receivership in 1993/1994, Vickers Shipbuilding and Engineering in 1995 and Kværner Govan in 1999. In June 1998, MES acquired Tracor, a major American defence contractor, for £830 million (approx. US$1.4 billion c. 1998).

| Timeline of British aerospace companies since 1955 | |||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1950s | 1960s | 1970s | 1980s | 1990s | 2000s | ||||||||||||||||||||||||||||||||||||||||||||

| 5 | 6 | 7 | 8 | 9 | 0 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 0 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 0 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 0 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 0 | 1 | 2 | 3 | 4 |

| Short Brothers and Harland Ltd. | Short Brothers Ltd. | Short Brothers plc | |||||||||||||||||||||||||||||||||||||||||||||||

| Handley Page | |||||||||||||||||||||||||||||||||||||||||||||||||

| F. G. Miles | Beagle Aircraft | ||||||||||||||||||||||||||||||||||||||||||||||||

| Auster | |||||||||||||||||||||||||||||||||||||||||||||||||

| Scottish Aviation | British Aerospace (BAe) | BAE Systems | |||||||||||||||||||||||||||||||||||||||||||||||

| Blackburn | Hawker Siddeley Aviation Hawker Siddeley Dynamics |

||||||||||||||||||||||||||||||||||||||||||||||||

| Avro | |||||||||||||||||||||||||||||||||||||||||||||||||

| de Havilland | |||||||||||||||||||||||||||||||||||||||||||||||||

| Folland | |||||||||||||||||||||||||||||||||||||||||||||||||

| Hawker Siddeley | |||||||||||||||||||||||||||||||||||||||||||||||||

| Vickers-Armstrongs | British Aircraft Corporation (BAC) | ||||||||||||||||||||||||||||||||||||||||||||||||

| English Electric | |||||||||||||||||||||||||||||||||||||||||||||||||

| Bristol | |||||||||||||||||||||||||||||||||||||||||||||||||

| Hunting | |||||||||||||||||||||||||||||||||||||||||||||||||

| The General Electric Company (GEC) | The Marconi Company | GEC-Marconi/Marconi Electronic Systems | |||||||||||||||||||||||||||||||||||||||||||||||

| The English Electric Company | Marconi plc | ||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||

| 1960s | 1970s | 1980s | 1990s | 2000s | 2010s | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 0 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 0 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 0 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 0 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 0 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 0 | 1 | ||||||||

| Hawthorn Leslie & Company | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Caledon Sh'b. & Eng. Co. | Robb Caledon Shipbuilding | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Henry Robb | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Harland and Wolff | Harland & Wolff Heavy Industries | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Ailsa Shipbuilding Company | Ferguson Ailsa | Ailsa & Perth | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Ferguson Brothers | Ferguson Shipbuilders | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Lithgows | Scott Lithgow | Scott Lithgow | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Scotts Sh'b. & Eng. Co. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Greenock Dockyard Co. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Swan Hunter & Wigham Richardson | Swan Hunter Group | Swan Hunter | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Smiths Dock Co. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| John Readhead & Sons | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Hall Russell & Co. | Hall Russell | A&P | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Austin & Pickersgill | North East Shipbuilders Ltd. | A&P Appledore International | A&P Group | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| William Doxford & Sons | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Appledore Shipbuilders | DML Appledore | Babcock Marine Appledore | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Cammell Laird & Company | VSEL | Coastline | Cammell Laird | A&P Shiprepair | NWSL | CLSS | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Vickers-Armstrongs | Vickers Ltd. Shipbuilding | Marconi Marine (VSEL) | BAE Systems Marine | BAE Sub. Solutions | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Yarrow & Co. | Y'w. Sh'b. Ltd. | Upper Clyde Shipbuilders | YSL | Marconi Marine (YSL) | BAE Surf. Flt. Solutions | BVT Surface Fleet | BAE Systems Surface Ships | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fairfield Sh'b. & Eng. Co. | Govan Sh'b. | Kvaerner Govan | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Charles Connell & Company | Scotstoun Marine | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| John Brown & Company | Marathon (Clydebank) | UiE Scotland | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Alexander Stephens & Sons | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| W. Denny & Bros. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| A. & J. Inglis | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Simons & Lobnitz | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Barclay Curle | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| J. I. Thornycroft & Co. | Vosper Thornycroft | Vosper Thornycroft | VT Group | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Vosper & Co. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| British Hovercraft Corporation | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Hoverwork Ltd. | Griffon Hoverwork | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Griffon Hovercraft Ltd. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 0 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 0 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 0 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 0 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 0 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 0 | 1 | ||||||||

| 1960s | 1970s | 1980s | 1990s | 2000s | 2010s | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| BSC = British Shipbuilders Corporation | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Formation

The 1997 merger of American corporations Boeing and McDonnell Douglas, which followed the forming of Lockheed Martin, the world's largest defence contractor in 1995, increased the pressure on European defence companies to consolidate. In June 1997 British Aerospace Defence managing director John Weston commented "Europe... is supporting three times the number of contractors on less than half the budget of the U.S.". European governments wished to see the merger of their defence manufacturers into a single entity, a European Aerospace and Defence Company.

As early as 1995 British Aerospace and the German aerospace and defence company DaimlerChrysler Aerospace (DASA) were said to be keen to create a transnational aerospace and defence company. The two companies envisaged including Aérospatiale, the other major European aerospace company, but only after its privatisation. The first stage of this integration was seen as the transformation of Airbus from a consortium of British Aerospace, DASA, Aérospatiale and Construcciones Aeronáuticas SA into an integrated company; in this aim British Aerospace and DASA were united against the various objections of Aérospatiale. As well as Airbus, British Aerospace and DASA were partners in the Panavia Tornado and Eurofighter Typhoon aircraft projects. Merger discussions began between British Aerospace and DASA in July 1998, just as French participation became more likely with the announcement that Aérospatiale was to merge with Matra and emerge with a diluted French government shareholding. A merger was agreed between British Aerospace chairman Richard Evans and DASA CEO Jürgen Schrempp in December 1998.

Meanwhile GEC was also under pressure to participate in defence industry consolidation. Reporting the appointment of George Simpson as GEC managing director in 1996, The Independent had said "some analysts believe that Mr Simpson's inside knowledge of BAe, a long-rumoured GEC bid target, was a key to his appointment. GEC favours forging a national 'champion' defence group with BAe to compete with the giant US organisations." When GEC put MES up for sale on 22 December 1998, British Aerospace abandoned the DASA merger in favour of purchasing its British rival. The merger of British Aerospace and MES was announced on 19 January 1999. Evans stated that in 2004 that his fear was that an American defence contractor would acquire MES and challenge both British Aerospace and DASA. The merger created a vertically integrated company which The Scotsman described as "[a combination of British Aerospace's] contracting and platform-building skills with Marconi's coveted electronics systems capability", for example combining the manufacturer of the Eurofighter with the company that provided many of the aircraft's electronic systems; British Aerospace was MES' largest customer. In contrast, DASA's response to the breakdown of the merger discussion was to merge with Aérospatiale to create the European Aeronautic Defence and Space Company ( EADS), a horizontal integration. EADS has since considered a merger with Thales to create a "fully rounded" company.

Seventeen undertakings were given by BAE to the Department of Trade and Industry which prevented a reference of the merger to the Monopolies and Mergers Commission. These were largely to ensure that the integrated company would tender sub-contracts to external companies on an equal basis with its subsidiaries. Another condition was the " firewalling" of former British Aerospace and MES teams on defence projects such as the Joint Strike Fighter (JSF). In 2007 the government, on advice from the Office of Fair Trading, announced it had agreed to release BAE from ten of the undertakings due to "a change in circumstances".

BAE inherited the "special" shareholding that was established when British Aerospace was privatised. This special share, with a nominal value of £1, is held on behalf of the Secretary of State for Trade and Industry. This shareholding prevents amendments of certain parts of the company's Articles of Association without the permission of the Secretary of State. These Articles require that no foreign person or persons acting together may hold more than 15% of the company's shares or control the majority of the board and that the CEO and the Chairman of BAE Systems must be British nationals.

British Aerospace's head office was in Warwick House, Farnborough Aerospace Centre in Farnborough, Hampshire. BAE retains this but the registered office, and base for the senior leadership team, is in the City of Westminster.

Expansion and restructuring

BAE Systems' first annual report identified Airbus, support services to militaries and integrated systems for air, land and naval applications as key areas of growth. It also stated the company's desire to both expand in the US and participate in further consolidation in Europe. BAE described 2001 as an "important year" for its European joint ventures, which were reorganised considerably. BAE has described the rationale for expansion in the US; "[it] is by far the largest defence market with spend running close to twice that of the Western European nations combined. Importantly, US investment in research and development is significantly higher than in Western Europe." When Dick Olver was appointed chairman in July 2004 he ordered a review of the company's businesses which ruled out further European acquisitions or joint ventures and confirmed a "strategic bias" for expansion and investment in the US. The review also confirmed the attractiveness of the land systems sector and, with two acquisitions in 2004 and 2005, BAE moved from a limited land systems supplier to the second largest such company in the world. This shift in strategy was described as "remarkable" by the Financial Times. Between 2008 and early 2011 BAE acquired five cyber security companies in a shift in strategy to take account of reduced spending by governments on "traditional defence items such as warships and tanks".

In 2000 Matra Marconi Space, a joint BAE/Matra company, was merged with the space division of DASA to form Astrium. On 16 June 2003 BAE sold its 25% share to EADS for £84 million, however due to the lossmaking status of the company BAE invested an equal amount for "restructuring". In January 2001 Airbus Industrie was transformed from an inherently inefficient consortium structure to a formal joint stock company. BAE sold its 54% majority share of BAE Systems Canada, an electronics company, in April for $CAD310 (approx. £197 million as of December 2010). In November 2001, BAE announced the closure of the Avro Regional Jet ( Avro RJ) production line at Woodford and the cancellation of the Avro RJX, an advanced series of the aircraft family, as the business was "no longer viable". The final Avro RJ to be completed became the last British civil airliner. In November 2001 BAE sold its 49.9% share of Thomson Marconi Sonar to Thales for £85 million. A further step of European defence consolidation was the merger of BAE's share of Matra BAe Dynamics and the missile division of Alenia Marconi Systems (AMS) into MBDA in December. MBDA thus became the world's second largest missile manufacturer. Although EADS has been reported to be interested in acquiring full control of MBDA, BAE has said that, unlike Airbus, MBDA is a "core business".

In June 2002, BAE confirmed it was in takeover discussions with TRW, an American aerospace, automotive and defence business. This was prompted by Northrop Grumman's £4.1 billion (approx. US$6 billion c. 2002) hostile bid for TRW in February 2002. A bidding war between BAE, Northrop and General Dynamics ended on 1 June when Northrop's increased bid of £5.1 billion was accepted. On 11 December 2002, BAE issued a shock profit warning due to cost overruns of the Nimrod MRA4 maritime reconnaissance/attack aircraft and the Astute-class submarine projects. On 19 February 2003 BAE took a charge of £750 million against these projects and the Ministry of Defence (MOD) agreed to pay a further £700 million of the cost. In 2000 the company had taken a £300 million "loss charge" on the Nimrod contract which was expected to cover "all the costs of completion of the current contract".

The UK government, following a cabinet row described as "one of the most bitter Cabinet disputes over defence contracts since the Westland helicopter affair in 1985", ordered 20 BAE Hawk trainer aircraft with 24 options in July 2003 in a deal worth £800 million. The deal was significant because it was a factor in India's decision to finalise a £1 billion order for 66 Hawks in March 2004. Also in July 2003 BAE Systems and Finmeccanica announced their intention to set up three joint venture companies, to be collectively known as Eurosystems. These companies would have pooled the avionics, C4ISTAR and communications businesses of the two companies. However the difficulties of integrating the companies in this way led to a re-evaluation of the proposal; BAE's 2004 Annual Report states that "recognising the complexity of the earlier proposed Eurosystems transaction with Finmeccanica we have moved to a simpler model". The main part of this deal was the dissolution of AMS and the establishment of SELEX Sensors and Airborne Systems; BAE sold its 25% share of the latter to Finmeccanica for €400 million (approx. £270 million c. 2007) in March 2007.

In May 2004, it was reported that BAE was considering selling its shipbuilding divisions, BAE Systems Naval Ships and BAE Systems Submarines. It was understood that General Dynamics wished to acquire the submarine building facilities at Barrow-in-Furness, while VT Group was said to be interested in the remaining yards on the Clyde. However in 2008 BAE Systems merged its Surface Fleet arm with the shipbuilding operations of VT Group to form BVT Surface Fleet, an aim central to the British Government's Defence Industrial Strategy.

On 4 June 2004, BAE Systems outbid General Dynamics for Alvis Vickers, the UK's main manufacturer of armoured vehicles. Alvis Vickers was merged with BAE's RO Defence unit to form BAE Systems Land Systems. Recognising the lack of scale of this business compared to General Dynamics, BAE executives soon identified the US defence company United Defense Industries (UDI), a major competitor to General Dynamics, as a main acquisition target. On 7 March 2005 BAE announced the £2.25 billion (approx. US$4.2 billion c. 2005) acquisition of UDI. UDI, now BAE Systems Land and Armaments, manufactures combat vehicles, artillery systems, naval guns, missile launchers and precision guided munitions.

In December 2005, BAE announced the sale of its German naval systems subsidiary, Atlas Elektronik, to ThyssenKrupp and EADS. The sale was complicated by the requirement of the German government to approve any sale. The Financial Times described the sale as "cut price" because French company Thales bid €300 million, but was blocked from purchasing Atlas on national security grounds. On 31 January 2006 BAE announced the sale of BAE Systems Aerostructures to Spirit AeroSystems, Inc. BAE said as early as 2002 that it wished to dispose of what it did not regard as a "core business".

On 18 August 2006 Saudi Arabia signed a contract worth £6 billion to £10 billion for 72 Eurofighter Typhoons, to be delivered by BAE. On 10 September 2006 BAE was awarded a £2.5 billion contract for the upgrade of 80 Royal Saudi Air Force Tornado IDSs. One of BAE's major aims, as highlighted in the 2005 Annual Report, was the granting of increased technology transfer between the UK and the US. The F-35 (JSF) programme became the focus of this effort, with British government ministers such as Lord Drayson, Minister for Defence Procurement, suggesting the UK would withdraw from the project without the transfer of technology that would allow the UK to operate and maintain F-35s independently. However, on 12 December 2006, Lord Drayson signed an agreement which allows "an unbroken British chain of command" for operation of the aircraft. On 22 December 2006 BAE received a £947 million contract to provide guaranteed availability of Royal Air Force (RAF) Tornados.

On 7 May 2007 BAE announced its subsidiary BAE Systems Inc. was to purchase Armor Holdings for £2.3 billion (approx. US$4.5 billion c. 2007) and completed the deal on 31 July 2007. The company is a manufacturer of tactical wheeled vehicles and a provider of vehicle and individual armour systems and survivability technologies. BAE (and British Aerospace previously) was a technology partner to the McLaren Formula One team from 1996 to December 2007. The partnership originally focused on McLaren's F1 car's aerodynamics, eventually moving on to carbon fibre techniques, wireless systems and fuel management. BAE's main interest in the partnership was to learn about the high speed build and operations processes of McLaren.

BAE announced the acquisition of Tenix Defence, a major Australian defence contractor on 18 January 2008. The purchase was completed on 27 June for A$775 million (£373 million) making BAE Systems Australia that country's largest defence contractor. The UK Ministry of Defence awarded BAE a 15-year munitions contract in August 2008 worth up to £3 billion. The contract guarantees supply of 80% of the UK Armed Forces' ammunition and required BAE to modernise its munitions manufacturing facilities. BAE expanded its intelligence and security business with the £531 million purchase of Detica Group in July 2008. It continued this strategy with purchases of Danish cyber and intelligence company ETI for approximately $210 million in December 2010, and Norkom Group PLC the following month for €217 million. The latter provides counter fraud and anti-money laundering solutions to the global financial services industry where its software assists institutions to comply with regulations on financial intelligence and monitoring.

In February 2010 BAE announced a £592 million writedown of the former Armor Holdings business following the loss of the Family of Medium Tactical Vehicles contract in 2009. BAE was outbid by Oshkosh Corporation for the £2.3 billion ($3.7 billion) contract. Land and Armaments had been the "star performer" of BAE's subsidiaries, growing from sales of £482 million in 2004 to £6.7 billion in 2009.

BAE inherited British Aerospace's 35% share of Saab AB, with which it produced and marketed the Gripen fighter aircraft. In 2005 it reduced this share to 20.5% and in March 2010 announced its intention to sell the remainder. The Times stated that the decision brought "to an end its controversial relationship with the Gripen fighter aircraft". Several of the export campaigns for the aircraft were subject to allegations of bribery and corruption. Meanwhile the company was increasing its presence in India with the formation of Defence Land Systems India in April, a joint venture with Mahindra & Mahindra Limited. BAE holds just 26% of the equity due to Indian foreign direct investment regulations.

BAE continued its move into support services in May 2010 with the purchase of the marine support company Atlantic Marine for $352 million. In September 2010 BAE announced plans to sell the Platform Solutions division of BAE Systems Inc., which the Financial Times said could yield as much as £1.3 billion. However, despite "considerable expressions of interest", the sale was abandoned in January 2011. On 19 October 2010 the British government cancelled the Nimrod project as part of its Strategic Defence and Security Review. The purchases of Queen Elizabeth-class aircraft carrier, the Astute class submarines, and the Type 26 frigates were all confirmed. A new generation of nuclear missile submarines will be built, however the final decision will be delayed until after the next election.

BAE Systems sold the regional aircraft lease portfolio and asset management arm of its BAE Systems Regional Aircraft business in May 2011. This unit leases the BAe 146/Avro RJ family, BAe ATP, Jetstream and BAe 748. BAE retained the support and engineering activities of the business as part of the transaction.

In September 2011, BAE Systems began consultation with unions and workers over plans to cut nearly 3,000 jobs, mostly in the company's military aircraft division.

In its 2012 half-year report, the company revealed a 10% decline in revenue in the six months up to the 30 June due to falling demand for armaments. In May 2012 the governments of the UK and Saudi Arabia reached an agreement on an arms package which saw a £1.6 billion contract awarded to BAE for the delivery of 55 Pilatus PC-21 and 22 BAE Systems Hawk aircraft. The Sultanate of Oman ordered Typhoon and Hawk aircraft worth £2.5 billion in December 2012.

On 13 September 2012, it was reported that BAE Systems and EADS had entered possible merger talks. In case of a potential tie-up, BAE shareholders would own 40% and EADS' 60% of the new organisation. However, on 10 October 2012, the companies said the merger talks had been called off.

BAE Systems inherited British Aerospace's share of Airbus Industrie, which consisted of two factories at Broughton and Filton. These facilities manufactured wings for the Airbus family of aircraft. In 2001 Airbus was incorporated as Airbus SAS, a joint stock company. In return for a 20% share in the new company BAE transferred ownership of its Airbus plants (known as Airbus UK) to the new company.

Despite repeated suggestions as early as 2000 that BAE wished to sell its 20% share of Airbus, the possibility was consistently denied by the company. However on 6 April 2006 BBC News reported that it was indeed to sell its stake, then "conservatively valued" at £2.4 billion. Due to the slow pace of informal negotiations, BAE exercised its put option which saw investment bank Rothschild appointed to give an independent valuation. Six days after this process began, Airbus announced delays to the A380 with significant effects on the value of Airbus shares. On 2 June 2006 Rothschild valued BAE's share at £1.87 billion, well below BAE's, analysts' and even EADS' expectations. The BAE board recommended that the company proceed with the sale. On 4 October 2006 shareholders voted in favour and the sale was completed on 13 October. BAE's sale of its Airbus share saw the end of UK owned involvement in civil airliner production. Airbus Operations Ltd (the former Airbus UK) continues to be the Airbus "Centre of Excellence" for wing production, employing over 9,500, but is entirely owned by EADS.

Products

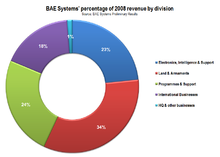

BAE plays a significant role in the production of military equipment. In 2008, 95% of BAE Systems' total sales were military related.

BAE plays important roles in military aircraft production. The company's Typhoon fighter and Tornado fighter-bomber are both front line aircraft of the RAF. BAE is a major partner in the F-35 Lightning II programme. Its Hawk advanced jet trainer aircraft has been widely exported. In July 2006, the British government declassified the HERTI (High Endurance Rapid Technology Insertion), an Unmanned Aerial Vehicle (UAV) which can navigate autonomously.

BAE Systems Land and Armaments manufactures the M2/M3 Bradley fighting vehicle family, the US Navy Advanced Gun System (AGS), the M113 armoured personnel carrier (APC), the M109 Paladin, the British Army's Challenger II, Warrior Tracked Armoured Vehicle, M777 howitzer and the Panther Command and Liaison Vehicle

Major naval projects include the Astute class nuclear submarine, Type 45 air defence destroyer and Queen Elizabeth class aircraft carrier.

Areas of business

BAE Systems defines its "home markets" to be Australia, India, Saudi Arabia, the UK and the US.

United Kingdom

BAE Systems is the predominant supplier to the UK Ministry of Defence; in 2009/2010 BAE Systems companies in the list of Top 100 suppliers to the MOD received contracts totalling £3.98 billion, with total revenue being higher when other subsidiary income is included. In comparison the second largest supplier is Babcock International Group and its subsidiaries, with a revenue of £1.1 billion from the MOD. Oxford Economic Forecasting states that in 2002 BAE's UK businesses employed 111,578 people, achieved export sales of £3 billion and paid £2.6 billion in taxes. These figures exclude the contribution of Airbus UK.

Since its creation BAE had a difficult relationship with the MOD. This was attributed to deficient project management by the company, but also in part to the deficiencies in the terms of "fixed price contracts". BAE CEO Mike Turner said in 2006 "We had entered into contracts under the old competition rules that frankly we shouldn't have taken". These competition rules were introduced by Lord Levene during the 1980s to shift the burden of risk to the contractor and were in contrast to "cost plus contracts" where a contractor was paid for the value of its product plus an agreed profit.

BAE was operating in "the only truly open defence market", which meant that it was competing with US and European companies for British defence projects, while they were protected in their home markets. The US defence market is competitive, however largely between American firms, while foreign companies are excluded. In December 2005 the MOD published the Defence Industrial Strategy (DIS) which has been widely acknowledged to recognise BAE as the UK's "national champion". The DIS identifies key industrial capabilities which must be maintained within the UK through long-term government commitments to support research spending and procurement. Of these capabilities, several are dominated by BAE, including naval vessels and submarines, combat vehicles, fixed-wing aircraft, general munitions (with the exception of certain "niche capabilities abroad") and Network Enabled Capability (defined as C4ISTAR in the DIS). The company maintains an interest in future UAV technologies through its collaborative FLAVIIR research programme with EPSRC.

After the publication of the DIS BAE Systems CEO Mike Turner said "If we didn't have the DIS and our profitability and the terms of trade had stayed as they were... then there had to be a question mark about our future in the UK". Lord Levene said in the balance between value for money or maintaining a viable industrial base the DIS "tries as well as it can to steer a middle course and to achieve as much as it can in both directions. ...We will never have a perfect solution."

In May 2012, BAE was awarded a £328m contract to design the UK's next generation nuclear-armed submarines, by Ministry of Defence.

United States

The attraction of MES to British Aerospace was largely its ownership of Tracor, a major American defence contractor. Since its creation the company has steadily increased its investment in and revenues from the US.

BAE now sells more to the US Department of Defense (DOD) than the UK MOD. The company has been allowed to buy important defence contractors in the US, however its status as a UK company requires that its US subsidiaries are governed by American executives under Special Security Arrangements. BAE faces fewer impediments in this sense than its European counterparts, as there is a high degree of integration between the US and UK defence establishments. BAE's purchase of Lockheed Martin Aerospace Electronic Systems in November 2000 was described by John Hamre, CEO of the Centre for Strategic and International Studies and former Deputy Secretary of Defense, as "precedent setting" given the advanced and classified nature of many of that company's products.

The possibility of a merger between BAE and major North American defence contractors has long been reported, including Boeing, General Dynamics, Lockheed Martin, and Raytheon.

Rest of world

BAE Systems Australia is the largest defence contractor in Australia, having more than doubled in size with the acquisition of Tenix Defence. The Al Yamamah agreements between the UK and Saudi Arabia require "the provision of a complete defence package for the Kingdom of Saudi Arabia"; BAE employs 4,600 people in the kingdom. BAE Systems Land Systems South Africa, 75% owned by BAE, is the largest military vehicle manufacturer in South Africa, and is currently taking part in the US MRAP programme. BAE's interests in Sweden are a result of the purchases of Alvis Vickers and UDI, which owned Hägglunds and Bofors respectively; The companies are now part of BAE Systems AB and have a combined workforce of approximately 1,750. Also, BAE Systems owns 49% of Air Astana, Kazakhstan.

As of 8 October 2012 BAE listed the following as "significant" shareholders: Invesco Perpetual (13.38%), BlackRock (4.66%), Franklin Templeton Investments, (3.95%) and Legal & General, (3.62%).

Corporate governance

BAE Systems' chairman is Dick Olver. The executive directors are Ian King (CEO), Linda Hudson, and George Rose. The non-executive directors are Harriet Green, Michael Hartnall, Sir Peter Mason, Carl Symon, Roberto Quarta, Paul Anderson and Nick Rose.

The company's first CEO, John Weston, was forced to resign in 2002 in a boardroom "coup" and was replaced by Mike Turner. The Business reported that Weston was ousted when non-executive directors informed the chairman that they had lost confidence in him. Further, it was suggested that at least one non-executive director was encouraged to make such a move by the MOD due to the increasingly fractious relationship between BAE and the government. As well as the terms of the Nimrod contract, Weston had fought against the MOD's insistence that one of the first three Type 45 destroyers should be built by VT Group. The Business said he considered this "competition-policy gone mad".

It is understood that Turner had a poor working relationship with senior MOD officials, (for example with former Defence Secretary Geoff Hoon) Significantly the first meeting between Olver and Hoon was said to have gone well, a MOD official commented "He is a man we can do business with. We think it is good to be taking a fresh look at things." It has been suggested that relations between Turner and Olver were tense. On 16 October 2007 BAE announced that Mike Turner would retire in August 2008. The Times called his departure plans "abrupt" and a "shock", given previous statements that he wished to retire in 2013 at the age of 65. Despite suggestions that BAE would prefer an American CEO due to the increasing importance of the United States defence market to the company and the opportunity to make a clean break from corruption allegations and investigations related to the Al Yamamah contracts BAE announced on 27 June 2008 that it had selected the company's Chief operating officer Ian King to succeed Turner with effect from 1 September 2008; The Financial Times noted that King's career at Marconi distances him from the British Aerospace-led Al Yamamah project.

Financial information

Financial information for the Company is as follows:

| Turnover (£ million) | Profit/(loss) before tax (£m) | Net profit/(loss) (£m) | Earnings per share (p) | |

|---|---|---|---|---|

| 2012-12-31 | 17,834 | 1,369 | 1,079 | 33.0 |

| 2011-12-31 | 19,154 | 1,466 | 1,256 | 36.9 |

| 2010-12-31 | 22,392 | 1,444 | 1,081 | 30.5 |

| 2009-12-31 | 22,415 | 282 | (45) | (1.9) |

| 2008-12-31 | 18,543 | 2,371 | 1,768 | 49.6 |

| 2007-12-31 | 15,710 | 1,477 | 1,177 | 26.0 |

| 2006-12-31 | 13,765 | 1,207 | 1,054 | 19.9 |

| 2005-12-31[a] | 12,581 | 909 | 761 | 13.9 |

| 2005-12-31 | 15,411 | 845 | 555 | 22.5 |

| 2004-12-31 | 13,222 | 730 | 3 | 17.4 |

| 2003-12-31[b] | 15,572 | 233 | 8 | 16.6 |

| 2002-12-31[b] | 12,145 | (616) | (686)[c] | 17.3 |

| 2001-12-31[b] | 13,138 | 70 | (128) | 23.4 |

| 2000-12-31[b] | 12,185 | 179 | (19) | 18.8 |

| 1999-12-31[b] | 8,929 | 459 | 328 | 29.4 |

[a]: Restated to exclude Airbus contributions. Included for comparison.

[b]: Data prepared using UK GAAP guidelines. Recent data prepared using International Financial Reporting Standards.

[c]: Reflects £750 million charges for problems with Nimrod MRA4 (£500 million) and Astute class submarine (£250 million) programmes.

Corruption investigations

Serious Fraud Office

BAE Systems has been under investigation by the Serious Fraud Office, into the use of political corruption to help sell arms to Chile, Czech Republic, Romania, Saudi Arabia, South Africa, Tanzania and Qatar. In response, BAE Systems' 2006 Corporate Responsibility Report states "We continue to reject these allegations...We take our obligations under the law extremely seriously and will continue to comply with all legal requirements around the world. In June 2007 Lord Woolf was selected to lead what the BBC described as an "independent review.... [an] ethics committee to look into how the defence giant conducts its arms deals." The report, Ethical business conduct in BAE Systems plc – the way forward, made 23 recommendations, measures which BAE has committed to implement. The finding stated that "in the past BAE did not pay sufficient attention to ethical standards in the way it conducted business," and was described by the BBC as "an embarrassing admission."

In September 2009, the Serious Fraud Office announced that it intended to prosecute BAE Systems for offences relating to overseas corruption. The Guardian claimed that a penalty "possibly of more than £500m" might be an acceptable settlement package. On 5 February 2010, BAE Systems agreed to pay £257m criminal fines to the US and £30m to the UK. The UK had already massively benefited from £43 billion contract in tax receipts and jobs in the UK, and dropped an anti-corruption investigation into the Al Yamamah contracts later taken up by US authorities. Crucially, under a plea bargain with the US Department of Justice, BAE was convicted of felony conspiracy to defraud the United States government and sentenced in March 2010 by U.S. District Court Judge John D. Bates to pay a $400 million fine, one of the largest fines in the history of the DOJ. U.S. District Judge John Bates said the company's conduct involved "deception, duplicity and knowing violations of law, I think it's fair to say, on an enormous scale". BAE did not directly admit to bribery, and is thus not internationally blacklisted from future contracts. Some of the £30m penalty BAE will pay in fines to the UK will be paid ex gratia for the benefit of the people of Tanzania. On 2 March 2010 Campaign Against Arms Trade and The Corner House were successful in gaining a High Court injunction on the Serious Fraud Office's settlement with BAE. The High Court may order a full review of the settlement.

Saudi Arabia

BAE (and British Aerospace previously) has long been the subject of allegations of bribery in relation to its business in Saudi Arabia. The UK National Audit Office (NAO) investigated the Al Yamamah contracts and has so far not published its conclusions, the only NAO report ever to be withheld. The MOD has stated "The report remains sensitive. Disclosure would harm both international relations and the UK's commercial interests." The company has been accused of maintaining a £60 million Saudi slush fund and was the subject of an investigation by the Serious Fraud Office (SFO). However, on 14 December 2006 it was announced that the SFO was "discontinuing" its investigation into BAE. It stated that representations to its Director and the Attorney General Lord Goldsmith had led to the conclusion that the wider public interest "to safeguard national and international security" outweighed any potential benefits of further investigation. The termination of the investigation has been controversial. In June 2007, the BBC's Panorama alleged BAE "paid hundreds of millions of pounds to the ex-Saudi ambassador to the US, Prince Bandar bin Sultan" in return for his role in the Al Yamamah deals. In late June 2007 the United States Department of Justice (DOJ) began a formal investigation into BAE's compliance with anti-corruption laws. On 19 May 2008 BAE confirmed that its CEO Mike Turner and non-executive director Nigel Rudd had been detained "for about 20 minutes" at two US airports the previous week and that the DOJ had issued "a number of additional subpoenas in the US to employees of BAE Systems plc and BAE Systems Inc as part of its ongoing investigation". The Times suggested that such "humiliating behaviour by the DOJ" is unusual toward a company that is co-operating fully.

A judicial review of the decision by the SFO to drop the investigation was granted on 9 November 2007. On 10 April 2008 the High Court ruled that the SFO "acted unlawfully" by dropping its investigation. The Times described the ruling as "one of the most strongly worded judicial attacks on government action" which condemned how "ministers 'buckled' to 'blatant threats' that Saudi cooperation in the fight against terror would end unless the ...investigation was dropped." On 24 April the SFO was granted leave to appeal to the House of Lords against the ruling. There was a two-day hearing before the Lords on 7 and 8 July 2008. On 30 July the House of Lords unanimously overturned the High Court ruling, stating that the decision to discontinue the investigation was lawful.

Others

In September 2005 The Guardian reported that banking records showed that BAE paid £1 million to Augusto Pinochet, the former Chilean dictator. The Guardian has also reported that "clandestine arms deals" have been under investigation in Chile and the UK since 2003 and that British Aerospace and BAE made a number of payments to Pinochet advisers. In 2003, HMS Sheffield was sold to the Chilean Navy for £27 million, however the government's profit from the sale was £3 million, after contracts worth £24 million were placed with BAE for upgrade and refurbishment of the ship.

BAE is alleged to have paid "secret offshore commissions" of over £7 million to secure the sale of HMS London and HMS Coventry to the Romanian Navy. BAE received a £116 million contract for the refurbishment of the ships prior to delivery; however the British taxpayer only received the scrap value of £100,000 each from the sale.

BAE ran into controversy in 2002 over the abnormally high cost of a radar system sold to Tanzania. The sale was criticised by several opposition MPs and the World Bank; Secretary of State for International Development Clare Short declared that BAE had "ripped off" developing nations. In December 2010, leaked US diplomatic communications revealed that Edward Hoseah, the Tanzanian prosecutor investigating misconduct by BAE, had confided in US diplomats that "his life may be in danger" and was being routinely threatened.

In January 2007, details of an investigation by the Serious Fraud Office into BAE's sales tactics in regard to South Africa were reported, highlighting the £2.3 billion deal to supply Hawk trainers and Gripen fighters as suspect. In May 2011, as allegations of bribery behind South Africa's Gripen procurement continued, BAE partner Saab AB issued strong denials of any illicit payments being made; however in June 2011 Saab announced that BAE had made unaccounted payments of roughly $3.5 million to a consultant, this revelation prompted South African Opposition parties to call for a renewed inquiry. The Gripen's procurement by the Czech Republic was also under investigation by the Serious Fraud Office in 2006 over allegations of bribery.

Criticism

- Espionage

In September 2003 The Sunday Times reported that BAE had hired a private security contractor to collate information about individuals working at the Campaign Against Arms Trade and their activities. In February 2007, it again obtained private confidential information from CAAT.

BAE was reported to be the target of cyber espionage that may have stolen secrets related to the Lockheed Martin F-35 Lightning II.

- Human rights records

Like many arms manufacturers, BAE has received criticism from various human rights and anti-arms trade organisations due to the human rights records of governments to which it has sold equipment. These include Indonesia, Saudi Arabia, and Zimbabwe.

- Nuclear weapons

In 2006, BAE was excluded from the portfolio of the government pension fund of Norway "because they develop and/or produce central components for nuclear weapons". "According to the ethical guidelines for the Government Pension Fund – Global, companies that produce weapons that through normal use may violate fundamental humanitarian principles shall be excluded from the fund." BAE is indirectly engaged in production of nuclear weapons – through its 37.5% share of MBDA it is involved with the production and support of the ASMP missile, an air-launched nuclear missile which forms part of the French nuclear deterrent. BAE is also the UK's only nuclear submarine manufacturer and thus produces a key element of the UK's nuclear weapons capability.

- Cluster bombs

BAE has in recent times been criticised for its role in the production of cluster bombs, due to the long term death/injury risks they cause to civilians; cluster bombs behave similar to land mines. However, after pressure campaigns from various human rights groups, BAE recently stated it no longer produces land mines or cluster bombs.