Chapter 8

Introduction to Risk and Return

By Boundless

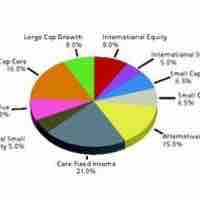

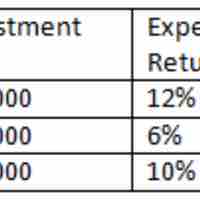

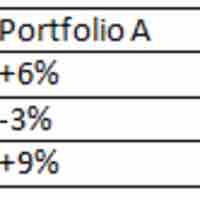

Weighting is the percent allocation a particular investment type receives within a portfolio.

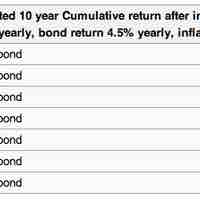

The expected return of a diversified portfolio is the expected return of each of its underlying investments times the weight the investment receives.

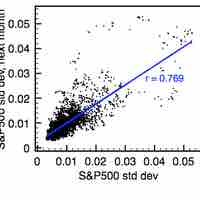

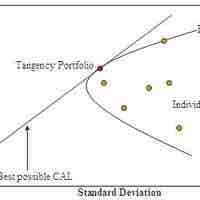

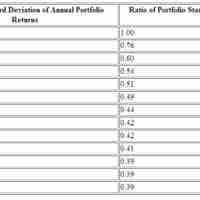

A diversified portfolio containing investments with small or negative correlation coefficients will have a lower variance than a single asset portfolio.

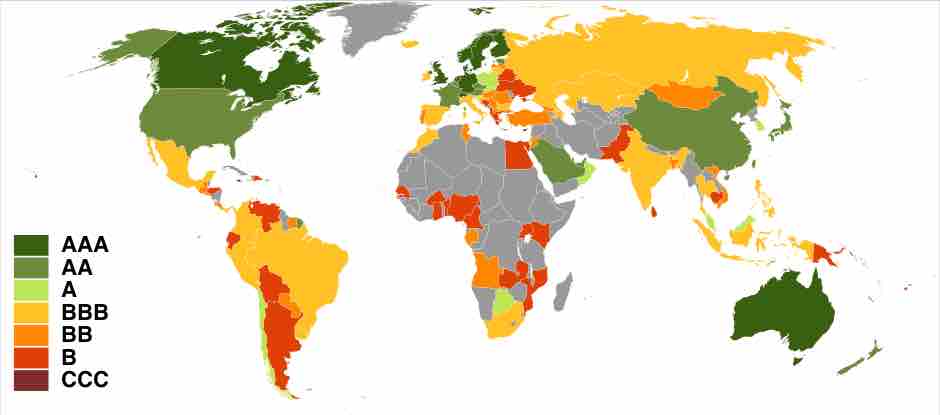

There are many types of financial risk, including asset-backed, prepayment, interest rate, credit, liquidity, market, operational, foreign, and model risk.

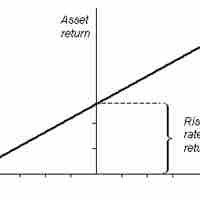

The higher the risk undertaken, the more ample the expected return and the lower the risk, the more modest the expected return.

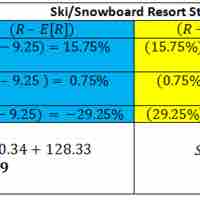

A portfolio's expected return is the sum of the weighted average of each asset's expected return.

The risk in a portfolio is measured as the amount of variance that investors can expect based on historical data.

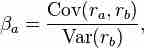

A portfolio's Beta is the volatility correlated to an underlying index.

In general, diversification can reduce risk without negatively impacting expected return.

Systematic risk is intrinsic to the market, and thusly diversification has no effect on its presence in investments.

Overall riskiness of an asset is composed of its own individual risk (beta) along with its risk in relation to the market as a whole.

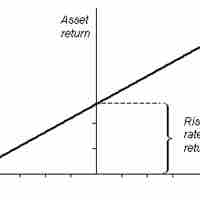

The security market line displays the expected rate of return of a security as a function of systematic, non-diversifiable risk.

The plotted location of an instrument on the SML has consequences on its price, return, and cost of capital it contributes to a firm.