Chapter 29

The Financial System

By Boundless

A financial intermediary is an institution that facilitates the flow of funds between individuals or other economic entities.

Savings are income after-consumption and investment is what is facilitated by saving.

The loanable funds market is a conceptual market where savers (suppliers) and borrowers (demanders) are able to establish a market clearing.

The time value of money is the principle that a certain amount of money today has a different buying power (value) than in the future.

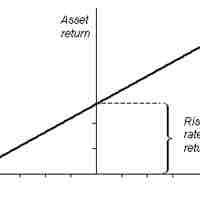

Risk is pervasive in the economy and is an essential component in the derivation of an asset's investment return.

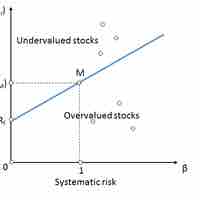

The compensation adjustment for holding an asset of a given risk profile can be further enhanced through asset diversification.

The security market line is useful to determine if an asset being considered for a portfolio offers a reasonable expected return for risk.