Chapter 8

Valuation and Reporting of Investments in Other Corporations

By Boundless

Types of investments include: 20% to 50% (as an asset), greater than 50% (as a subsidiary), and less than 20% (as an investment position).

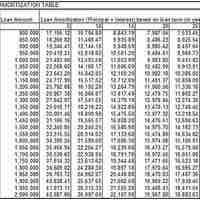

Due to different durations of holding and other factors, companies use several accounting methodologies, including amortized cost, fair value, and equity.

How debt sales are recorded depends on whether the debt is classified as "held-to-maturity," "a trading security," or "available-for-sale".

How the stock sale is accounted for depends on the type of stock sold.

Companies must calculate the fair market value for these available for sale securities at the end of each subsequent accounting period.

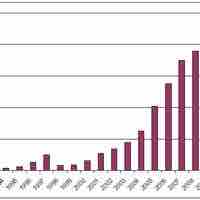

The ownership of less than 20% creates an investment position carried at fair market value in the investor's balance sheet.

Calculating fair value involves considering objective factors including acquisition, supply vs. demand, actual utility, and perceived value.

Stock investments of 20% or less are recorded at cost (considered its fair value) and reported as an asset on the balance sheet.

Equity method is the process of treating equity investments (usually 20–50%) of companies. The investor keeps such equities as an asset.

An investor has significant influence by holding 20% to 50% of shares, serving on the board, or participating in policy making.

Investments recorded under the equity method usually consist of stock ownership of a company between 20% to 50%.