Section 4

Accounts Receivable

Book

Version 3

By Boundless

By Boundless

Boundless Finance

Finance

by Boundless

4 concepts

Defining Accounts Receivable

Accounts receivable represents money owed by entities to the firm on the sale of products or services on credit.

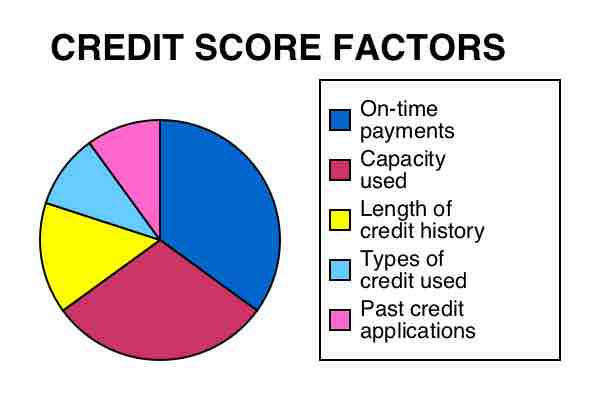

Setting a Credit Policy

To establish a credit policy, a company must establish credit standards, credit terms, and a collection policy.

Terms of Trade

Terms of trade credit include the amount of time allowable for payment to be received, including any potential discounts.

Collecting Receivables

Companies use different methods to collect their outstanding receivables, like sending out reminders or employing a collection agency.