Section 1

The Basics of the Cost of Capital

Book

Version 3

By Boundless

By Boundless

Boundless Finance

Finance

by Boundless

3 concepts

Defining the Cost of Capital

Risk, return, and the time value of money are central inputs in distilling the cost of capital as an investor or borrower.

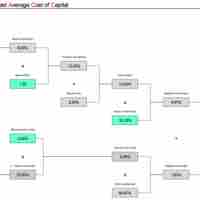

Differences Between Required Return and the Cost of Capital

The average cost of capital is calculated via combining the overall average required rate on debt stakeholders and equity stakeholders

Relationship Between Financial Policy and the Cost of Capital

Financial policy, not cost of capital, must be utilized to determine which investments to pursue, given that resources are limited.