Section 5

Long-Term Financing

Book

Version 6

By Boundless

By Boundless

Boundless Business

Business

by Boundless

5 concepts

Financial Leverage

Financial leverage is a technique used to multiply gains and losses by obtaining funds through debt instead of equity.

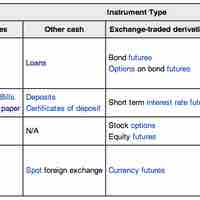

Debt Finance

Debt is a way for firms to access capital for operations or investment with various terms and agreements for future repayment .

Equity Finance

Companies can use equity financing to raise money and/or increase shareholder liquidity (through an IPO).

Long-Term Loans

Three common examples of long term loans are government debt, mortgages, and debentures (bonds).

Corporate Bonds

A corporate bond is issued by a corporation seeking to raise money in order to expand its business.