Section 2

Valuing Bonds

By Boundless

A bond's book value is affected by its term, face value, coupon rate, and discount rate.

A bond's value is measured by its sale price, but a business can estimate a bond's price before issuance by calculating its present value.

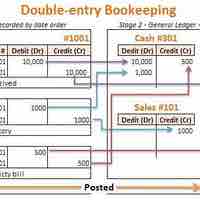

To record a bond issued at par value, credit the "bond payable" liability account for the total face value of the bonds and debit cash for the same amount.

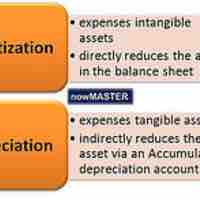

When a business sells a bond at a discount, it must record a discount balance in its records and amortize that amount over the bond's term.

When a bond is sold at a premium, the difference between the sales price and face value of the bond must be amortized over the bond's term.

The value of a zero-coupon bond equals the present value of its face value discounted by the bond's contract rate.