Section 2

Current Liabilities

By Boundless

Current liabilities are usually settled with cash or other assets within a fiscal year or operating cycle, whichever period is longer.

Accounts payable is money owed by a business to its suppliers and creditors and typically shown on its balance sheet as a current liability.

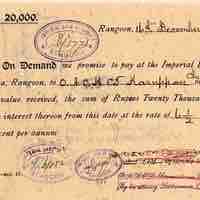

A note payable is a liability where one party makes an unconditional written promise to pay a specific sum of money to another.

The portion of long-term liabilities that must be paid in the coming 12-month period are classified as current liabilities.

Per FASB 6, current obligations that an enterprise intends and is able to refinance with long term debt have different reporting requirements.

Dividends are payments made by a corporation to its shareholders; the payment amount is reported as dividends payable on the balance sheet.

A deferred revenue is recognized when cash is received upfront for a product before delivery or for a service before rendering.

Other current liabilities reported on the balance sheet are sales tax, income tax, payroll, and customer advances (deferred revenue).