Section 2

The Balance Sheet

By Boundless

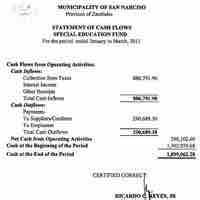

A balance sheet reports a company's financial position on a particular date.

The balance sheet relationship is expressed as; Assets = Liabilities + Equity.

The balance sheet of a business provides a snapshot of its financial status at a particular point in time.

Balance sheets are prepared with either one or two columns, with assets first, followed by liabilities and net worth.

Cash, receivables, and liabilities on the Balance Sheet are re-measured into U.S. dollars using the current exchange rate.

Assets on a balance sheet are classified into current assets and non-current assets. Assets are on the left side of a balance sheet.

The balance sheet contains details on company liabilities and owner's equity.

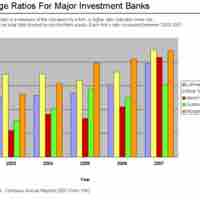

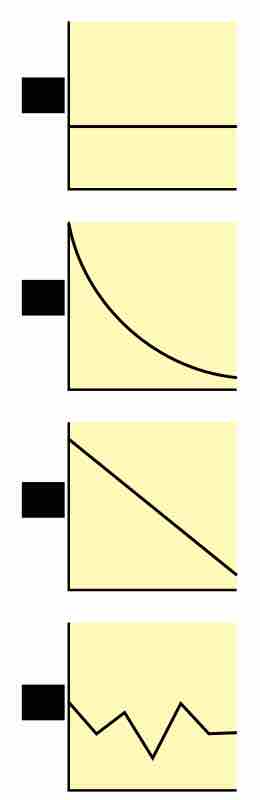

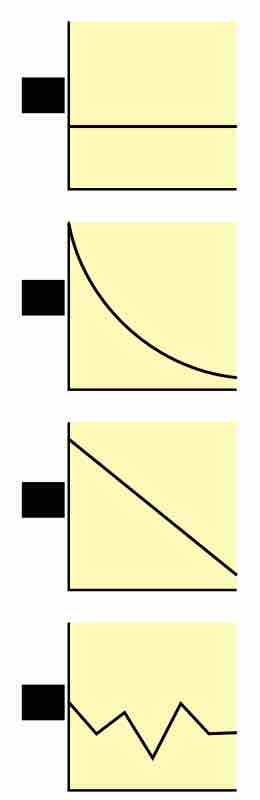

Liquidity, a business's ability to pay obligations, can be assessed using various ratios: current ratio, quick ratio, etc.

Working capital is a financial metric which represents operating liquidity available to a business, organization and other entity.

The debt-to-equity ratio (D/E) indicates the relative proportion of shareholder's equity and debt used to finance a company's assets.

Book value is the price paid for a particular asset, while market value is the price at which you could presently sell the same asset.

The three limitations to balance sheets are assets being recorded at historical cost, use of estimates, and the omission of valuable non-monetary assets.