The Now

Protecting Yourself from Data Breaches

Protecting yourself from data breaches

A lot of services these days require us to provide some of our personal information. This ranges from something as simple as our name or phone number to more sensitive data like our credit card numbers or login information. When we supply this information to websites, we trust them to keep it confidential and safe from others.

But sometimes, this information manages to be released through something called a data breach . Data breaches are when mass amounts of confidential information are illegally accessed by hackers and often made available publicly .

How do I protect myself from data breaches?

In order to best protect yourself from online data breaches, you should

limit how much sensitive information you store on certain websites

. Many sites offer to store your payment information so you don't have to re-enter it every time you buy something. This may sound convenient, but if the site is breached hackers will have access to this information.

However, there's not a whole lot you can do to prevent data breaches from happening when it comes to brick-and-mortar stores. Recent breaches have occurred where someone used an employee's credentials to access their database. Unfortunately, because of cases like this, no matter how careful you are online, your information could still be breached from physical stores.

What do I do after a data breach?

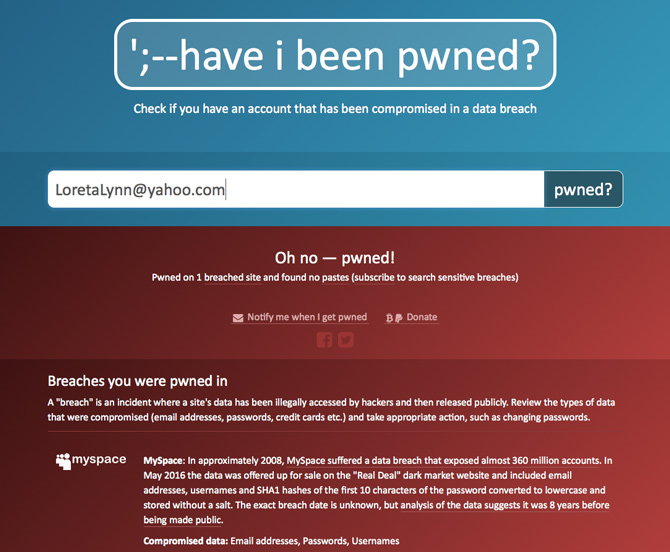

When a data breach does occur, many companies or websites will alert their customers and users. However, you may end up hearing about these breaches from other sources. Worse, you may not hear about it at all. You can use a website like have i been pwned? to determine if you were involved in a breach, and if so, what information was stolen.

If the breach occurred on a website you use, we strongly recommend changing your login information . In general, it's also a good idea to not use the same password across various websites and accounts.

What if my financial information was released?

If any type of financial information was breached, like credit card numbers or bank information, you should call the corresponding bank or organization to let them know . They can cancel your card(s), and you can work with them to try and prevent or resolve any fraudulent charges.

You can also use websites like Equifax , Experian , and TransUnion to place a fraud alert . This will inform credit grantors to verify your identity before extending credit , preventing individuals from opening credit cards and taking out loans in your name.